colorado estate tax form

Taxes 15-14-739. Property Taxation - Declaration Schedules.

DR 1093 - Annual Transmittal of State W-2 Forms.

. DR 1830 - Material Advisor Disclosure Statement for Colorado Listed Transaction. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Colorado estate tax form.

Form 104EP - Estimated Individual Income Tax Return. Included in the list should be a summary of the principals real estate personal property financial accounts business ownership and other notable assets. A state inheritance tax was enacted in Colorado in 1927.

The exemption for that tax is 1170 million for deaths in 2021 and 1206 million in 2022. DR 1094 - Colorado W-2 Wage Withholding Tax Return. 1st Avenue Suite C Denver CO 80230.

DR 8453F - Fiduciary Income Tax Declaration for Electronic Filing. Instructions for Closing an Estate Formally Download PDF Revised 0919 JDF 958 - Instructions for Closing a Small. The deadline to file a 2022 Exempt Property Report is April 15 2022.

Form 104PN - Nonresident Income Tax Return. Use schedule e on the fiduciary income tax return dr 0105 to make the apportionment. In 1980 the state legislature replaced the inheritance tax 1 with an estate tax.

Federal legislative changes reduced the state death. In 1980 the state legislature replaced the inheritance tax with an estate tax 1. DR 0253 - Income Tax Closing Agreement.

Does Colorado Have an Inheritance Tax or Estate Tax. DR 0104BEP- Colorado Nonresident Beneficiary Estimated Income Tax Payment Form. Ad Download Or Email Form 104x More Fillable Forms Register and Subscribe Now.

In 1980 the state legislature replaced the. DR 1210 - Colorado Estate Tax Return. Application for Change of Vehicle Information IRP DR 2413.

Small estate While a small estate offers the simplest and cheapest form of probate only estates worth less than 50000 can claim. Pursuant to 39-3-1195 the personal property minimum filing exemption threshold exemption amount for tax years 2021 and 2022 is 50000 or less in total actual value. DR 1098 - Colorado Income Tax Withholding Worksheet for Employers Withholding Worksheet Calculator DR 1106 - Annual Transmittal of State 1099 Forms.

Application for Low-Power Scooter Registration. A property-tax exemption is available to senior citizens surviving spouses of senior citizens and one hundred percent disabled veterans For those who qualify 50 percent of the first 200000 in the actual value of their primary residence is exempted from property taxation The state pays the exempted portion of the property tax The. DR 5714 - Request for Copy of Tax.

The rate threshold is the point at which the marginal estate tax rate kicks in. DR 0158-F - EstateTrust Extension of Time for Filing. Affidavit of Non-Commercial Vehicle.

Estimated tax payments are due on a. Their telephone number is 303 343-1268. Nonresidents of Colorado who need to file income taxes in the state need to file Form 104PN.

Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is based on this credit. DR 1102 - Address or Name Change Form. Hotel or Motel Mixed Use Questionnaire.

Days After Death At least ten 10 days must have passed since the death of the decedent before filing the affidavit. The estate tax is a tax applied on the transfer of a deceased persons assets. You might want to consider getting professional advice in the form of a financial advisor.

DR 0253 - Income Tax Closing Agreement. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. DR 1079 - Payment of Withholding Tax on Certain Colorado Real Property Interest Transfers.

For 2021 this amount is 117 million or 234 million for married couples. DR 0158-F - EstateTrust Extension of Time for Filing. Forms are mailed by March 1.

PdfFiller allows users to edit sign fill and share all type of documents online. All forms must be completed in English pursuant to Colorado law see 13-1-120 CRS. DR 0105 - Colorado Fiduciary Income Tax Return form only DR 0105EP - EstateTrust Estimated Tax Payment Form.

The decedent and their estate are separate taxable entities. If you have not received an annual report and instructions by postal mail by March 15 2022 please contact Exemptions at 303-864-7780 and provide your file number see previous years form and updated mailing address. 223 rows Sales Tax Return for Unpaid Tax from the Sale of a Business.

DR 1107 - Colorado 1099 Income Withholding Tax Return. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. DR 1083 - Information with Respect to a Conveyance of a Colorado Real Property Interest.

Colorado 2 withholding form and instructions. Affidavit of Non-residence and Military Exemption from Specific Ownership Tax. In other words when an estate is passed on the federal government taxes the transfer.

DR 0900F - Fiduciary Income Payment Form. Note however that the estate tax is only applied when assets exceed a given threshold. Federal legislative changes reduced the state death.

Application forms are available from the Colorado Department of Military and Veterans Affairs Division of Veterans Affairs 7465 E. Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is equal to this credit. But that there are still complicated tax matters you must handle once an individual passes away.

DR 1778 - E-Filer Attachment Form. Application for an Affidavit Emissions Extension. Youll want to make sure though that the financial advisor you.

Real Property Transfer Declaration TD-1000 Real Property Transfer Declaration Completion Guide TD-1000 Government Assisted Housing Questionnaire. Using the Current Assets List the principal can enter a description of all items presently part of their estate. Even though there is no estate tax in Colorado you may still owe the federal estate tax.

A state inheritance tax was enacted in Colorado in 1927. DR 0900F - Fiduciary Income Payment Form. There is no inheritance tax or estate tax in Colorado.

A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who. Step 3 Create a List of Assets. Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone.

Please submit completed declaration schedules to the Colorado county assessors office in which the property is located as. 15-12-12011bMaximum Amount The total value of the personal property in the decedents estate less any liens and encumbrances on that property must be less than an amount that is set based on the year of.

7 Mistakes To Avoid When Building A Home In Colorado Sheffield Homes Home Inspection Listing House Building A House

Estate Planning Checklist Estate Planning Checklist Funeral Planning Checklist Funeral Planning

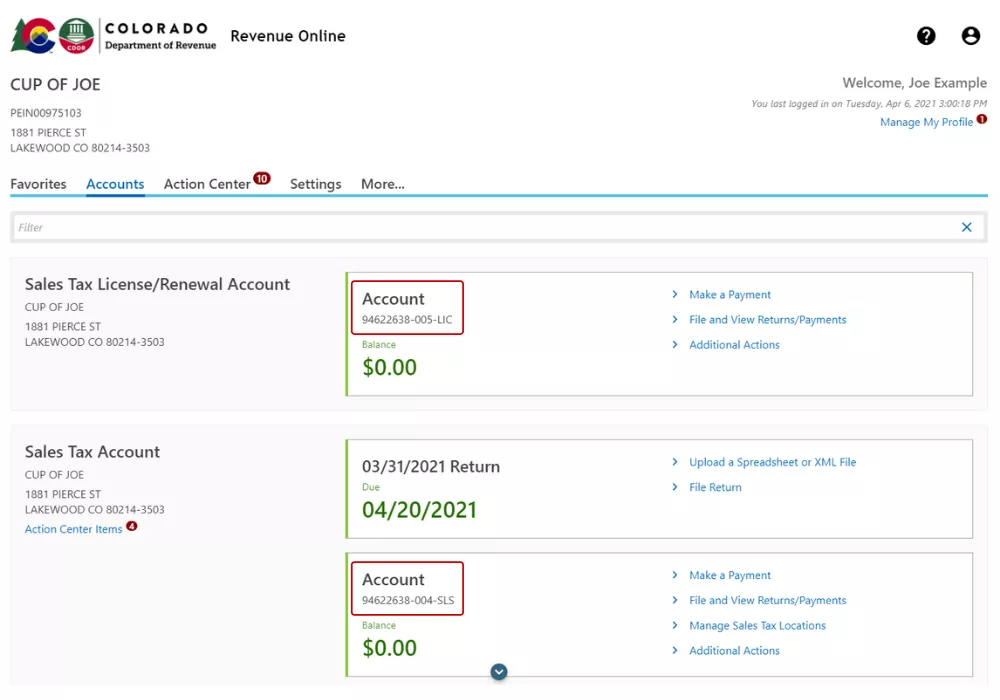

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Free Colorado Tax Power Of Attorney Form Dr 0145 Pdf Eforms

Colorado Civil Litigation Lawyer Civil Lawsuits Keating Lyden Llc Litigation Litigation Lawyer Civil Lawsuit

Colorado Income Tax Cuts Benefit The Rich Most Nonpartisan Analysis Finds

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Colorado Estate Tax Everything You Need To Know Smartasset

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Where S My Colorado State Tax Refund Taxact Blog

Colorado Estate Tax Everything You Need To Know Smartasset

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Prepare And Efile Your 2021 2022 Colorado State Tax Return

Colorado Estate Tax Everything You Need To Know Smartasset

Tax Rates Stranger Tallman Lautz Accounting Grand Junction Colorado

Financial Tip Of The Month Tax Prep Checklist Tax Prep Checklist Tax Prep Small Business Tax